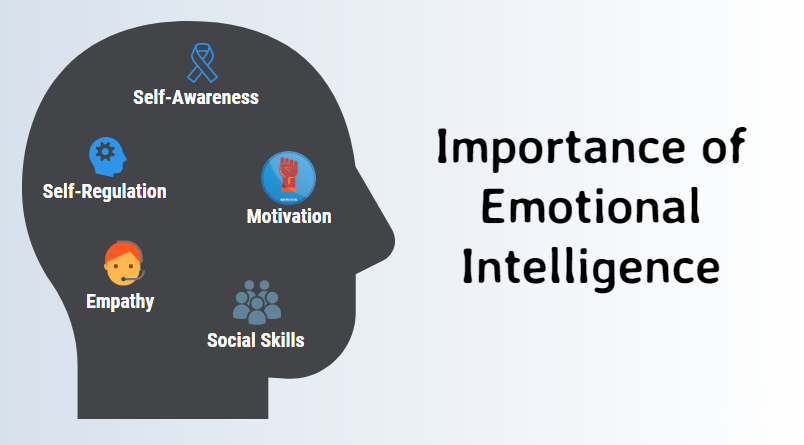

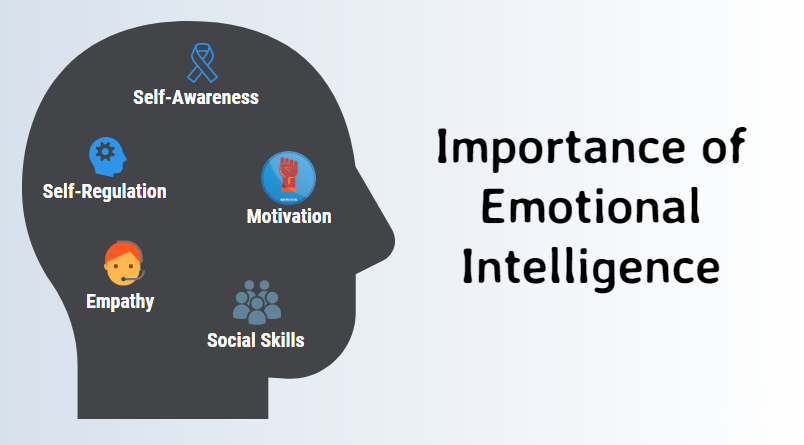

If one were to name one quality that organizations should look for in their employees more than any other, what would that be? Without a doubt, it has to be emotional intelligence or emotional quotient, EQ. As opposed to Intelligence Quotient, which is essentially about textbook and academic intelligence, EQ is about being intuitive and street smart, which is what makes people handle difficult situations on their own without having to refer to books.

No organization is luckier than the one in which its employees are gifted with this quality. Why? Because such employees are always thinking of ways by which they can become inventive and ingenuous in helping to take the business forward.

This quality is required for us not only in our roles as employees, but also in area of life itself. A person with a good level of EQ can manage and emerge out of any difficult situation, while all the time enjoying the prospect of doing so.

The good news is that these skills can be inculcated. A webinar from Traininng.com, a leading provider of professional training for the areas of regulatory compliance and human resources, will show how. Being organized on October 15, this webinar will bring Paul Byrne, a senior partner and trainer with Mackay Byrne Group, as the expert.

Please visit https://www.traininng.com/webinar/emotional-intelligence:-the-three-most-important-eq-skills-needed-in-business-today-201128live to register for this valuable learning session and again immense, crucial knowledge of how to implement EQ at work.

-----------------------------------------------------------------------------------------------------------------

This webinar will helps its participants explore the three areas of interaction that are necessary for people: Curiosity, Resilience, and Empathy. Anyone who has these qualities and adapts them in their daily interactions with people, in both their professional and social realms, is sure to be a winner all along. Such a person can make a strong influence on the people around her.

This webinar will show how to nurture these qualities and put them into practice. At the end of this session, participants will be able to implement these very crucial qualities in their future interactions and come up with positive results out of them.

Participants of this webinar will learn:

About the expert: Paul has been facilitating personal communication skills training for over fourteen years. He is also a professor of communications skills in Ottawa, Ontario.

Corporate clients have been consistently rewarded with his ability to translate academic theory and psychological research into practical communication techniques for the workplace. His training design and delivery skills have been applauded by clients coast to coast.

No organization is luckier than the one in which its employees are gifted with this quality. Why? Because such employees are always thinking of ways by which they can become inventive and ingenuous in helping to take the business forward.

This quality is required for us not only in our roles as employees, but also in area of life itself. A person with a good level of EQ can manage and emerge out of any difficult situation, while all the time enjoying the prospect of doing so.

The good news is that these skills can be inculcated. A webinar from Traininng.com, a leading provider of professional training for the areas of regulatory compliance and human resources, will show how. Being organized on October 15, this webinar will bring Paul Byrne, a senior partner and trainer with Mackay Byrne Group, as the expert.

Please visit https://www.traininng.com/webinar/emotional-intelligence:-the-three-most-important-eq-skills-needed-in-business-today-201128live to register for this valuable learning session and again immense, crucial knowledge of how to implement EQ at work.

-----------------------------------------------------------------------------------------------------------------

This webinar will helps its participants explore the three areas of interaction that are necessary for people: Curiosity, Resilience, and Empathy. Anyone who has these qualities and adapts them in their daily interactions with people, in both their professional and social realms, is sure to be a winner all along. Such a person can make a strong influence on the people around her.

This webinar will show how to nurture these qualities and put them into practice. At the end of this session, participants will be able to implement these very crucial qualities in their future interactions and come up with positive results out of them.

Participants of this webinar will learn:

- The skills of emotionally connecting with prospective and existing clients

- The simple skills of authentic client communication by knowing how to tap into the autobiographical urge of others

- Asking the right questions at the right time builds your emotional foundation with existing, or prospective clients

- The power of empathy and the importance of listening well.

About the expert: Paul has been facilitating personal communication skills training for over fourteen years. He is also a professor of communications skills in Ottawa, Ontario.

Corporate clients have been consistently rewarded with his ability to translate academic theory and psychological research into practical communication techniques for the workplace. His training design and delivery skills have been applauded by clients coast to coast.

Comments

Post a Comment